It’s no secret that launching a SaaS product is hard. Even if you have a great idea, there are countless obstacles to overcome before you can make your vision a reality. One of the biggest challenges is securing funding.

If you’re like most founders, you’ll need to raise capital from investors in order to get your business off the ground. But before you can do that, you may need to secure pre-seed funding.

In this article, Founderpath will be doing a deep dive into the topic of pre-seed funding. We’ll talk about what it is, how much you can raise, and how to get it.

So, if you’re currently looking into funding for your SaaS product, you’re in the right place!

What is pre-seed funding?

A start-up’s journey from idea to sustainable business usually passes through a series of funding stages—each with different goals and targets. While the stages can be fairly nebulous in practice, they’re usually defined as:

- Pre-Seed: The earliest stage of funding, in which a start-up seeks to validate its product or service. This is typically done through market research, customer interviews, and building a prototype.

- Seed: The stage at which a start-up seeks to establish its product or service in the market. This is typically done through marketing and building out the team.

- Series A: The stage at which a start-up seeks to scale its business. This is typically done through expansion into new markets and product development.

- Series B: The stage at which a start-up seeks to scale its business further. This is typically done through aggressive growth strategies.

- Series C: The stage at which a start-up seeks to achieve profitability or become “unicorn” status. This is typically done through consolidation and optimization.

While some stages get more attention than others, each can be make-or-break for SaaS founders hoping to build sustainable businesses. This is especially true in the pre-seed funding stage.

Pre-seed funding (also referred to as “family and friends” funding) is usually relatively limited in scope. However, this limited scope is still vital to a start-up’s chance of success. Without pre-seed funding, many founders struggle to move beyond the ideation stage—and their chances of ever raising significant outside capital diminish significantly.

What pre-seed funding options are there?

There are a few different ways to go about securing pre-seed funding. The most common are:

Bootstrapping

Bootstrapping is when a founder uses their own personal savings to finance their business. This is usually the least attractive option for founders, as it puts their personal finances at risk. However, it can be a good option for those who don’t want to give up equity in their company or take on debt.

Friends and Family

As the name suggests, this is when a founder raises money from their personal network of friends and family members. This is often the easiest form of pre-seed funding to secure, as investors will usually be more forgiving of early mistakes. However, it can also be the most difficult, as it can put a strain on personal relationships.

Angel Investors

Angel investors are wealthy individuals who invest their own money in start-ups. They usually have some connection to the founder, such as being a friend or family member. However, they can also be complete strangers. Angel investors usually invest smaller sums of money than venture capitalists, but they can provide valuable mentorship, and guidance, and connect you to other groups of investors.

Crowdfunding

Crowdfunding is when a founder raises money from a large group of people, typically through an online platform such as Kickstarter or Indiegogo. This can be a great way to raise pre-seed funding, as it doesn’t require giving up equity in your company. However, it can be difficult to reach your fundraising goals, and there’s no guarantee that you’ll be able to deliver on your promises.

Venture Capitalists

Venture capitalists are professional investors who invest other people’s money in start-ups. They usually invest larger sums of money than angel investors, but they also tend to be more hands-off. Venture capitalists typically invest in companies that have a higher chance of failing, but also a higher potential return if they succeed.

Accelerators and Incubators

Accelerators and incubators are programs that provide funding, mentorship, and resources to start-ups. They usually take equity in return for their services. Accelerators typically last for a set period of time (usually 3-6 months), while incubators are more like ongoing programs.

Loans

Loans and grants are another option for founders looking to finance their businesses. There are a few different types of loans that founders can apply for, including:

- Government Loans: These are government-backed loans that can be used for a variety of purposes, including start-up financing.

- Peer-to-peer Loans: These are loans that are funded by a group of individuals, rather than a bank or other financial institution.

- Personal Loans: These are loans that are taken out by the founder themselves. They can be used for any purpose, including start-up financing.

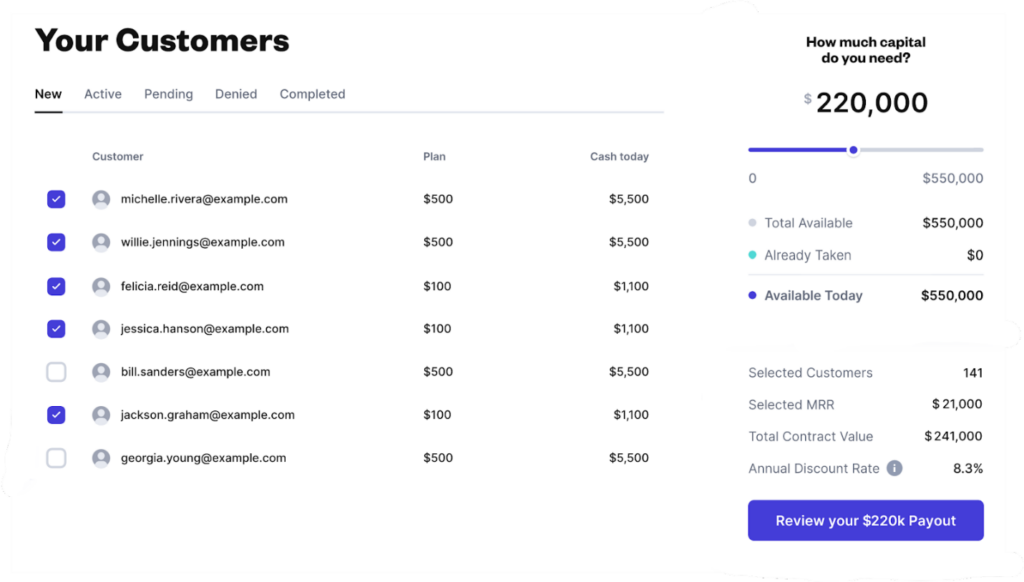

- Alternative Loans: These are non-traditional loans offered by private companies (like Founderpath) as alternatives to traditional loans from financial institutions and government agencies.

Now that you know a bit more about pre-seed funding, why should you care?

What are the benefits of pre-seed funding?

There are a few key benefits of pre-seed funding that make it an attractive option for founders:

1) Pre-seed funding can help you validate your business idea

One of the benefits of pre-seed funding is that it can help you validate your business idea through market research. When you have a solid business plan built on real-world data, everything becomes much simpler down the line.

If you can show that there is interest in your product or service, it will be much easier to secure additional funding from venture capitalists or other investors.

2) Pre-seed funding can help you build an MVP

Building a minimum viable product (MVP) is a huge hurdle for founders hoping to carve out a piece of their market. Without one, it’s hard to attract the attention of investors, users, or customers. There’s usually just too much competition!

Securing pre-seed funding is often the key to building a prototype or MVP. The extra cash can help you hire designers, developers, and other professionals who can turn your vision into a reality.

3) Pre-seed funding can help you hire a team

One of the benefits of pre-seed funding is that it can help you hire a team. When you have the financial resources to bring on additional employees, it can speed up the development of your product or service.

Hiring a team is essential for any start-up. You need people who are passionate about your mission and are dedicated to helping you achieve your goals. With the help of pre-seed funding, you can bring on talented individuals who will help take your business to the next level.

4) Pre-seed funding can help you attract future investors

One of the main benefits of pre-seed funding is that it can help you attract future investors. By demonstrating that you have a viable business and that you’re able to execute on your vision, you’re much more likely to secure the investment you need to take your business to the next level.

Pre-seed funding is also a great way to build relationships with potential investors. When you can show that you’re able to deliver on your promises, investors will be more likely to trust you with their money. Building strong relationships with investors is essential for any start-up founder.

What are the risks of pre-seed funding?

There are a few risks to consider before seeking pre-seed funding for your business.

1) You may not be able to find an investor

The biggest risk of pre-seed funding is that you may not be able to find an investor. This is especially true if you’re starting a business in a niche market or if your business model is unproven.

If you’re not able to secure funding, it could mean the end of your start-up before it even gets off the ground. Make sure you have a Plan B in place in case you can’t find an investor.

2) You may give up too much equity

Giving up too much equity is another potential downside of pre-seed funding. When you take on investors, they will want a return on their investment. This means that they will own a portion of your company.

Be sure to negotiate with investors to ensure that you don’t give up too much equity in your company. You should also have a lawyer review any agreements before you sign anything.

Note: The equity dilution trap isn’t unique to pre-seed funding—you’ll need to watch out for it at every funding stage you reach. Founderpath is on a mission to save bootstrapping SaaS founders from this fate by offering upfront capital based on monthly recurring revenue (MRR)—no equity dilution required!

3) It might take a while to receive the funds

If you opt for traditional pre-seed funding methods, it can often be a lengthy process. It can take weeks or even months to hear back from investors. This can be frustrating for founders who need funding quickly.

At Founderpath, we understand that time is of the essence for bootstrapping SaaS founders. That’s why we offer a quick and easy application process. We also provide funding in as little as 24 hours—so you can get back to scaling your business!

4) You might be locked into a crippling repayment schedule

Many pre-seed funding options come with high-interest rates and strict repayment terms. This can be difficult for founders who are just starting out and may not have the revenue to support the repayment schedule.

We don’t believe in putting SaaS founders in a compromising position. That’s why we offer flexible, long-term repayment terms without any hidden fees or penalties!

How to get pre-seed funding: quickfire tips

Securing pre-seed funding is one of the most important steps in starting your SaaS business. But it’s also one of the most difficult to obtain.

Investors and lenders are wary of untested products, so you’ll need to work extra hard to make them see your vision.

Here are a few tips to help you do just that:

1) Have a strong business plan

When you’re pitching to investors, it’s important to have a strong business plan. This will give investors’ confidence in your ability to execute your vision. Make sure your business plan is clear, concise, and well-researched.

Since pre-seed funding is typically aimed at bootstrapping SaaS start-ups, it’s important to have a proven business model. Make sure that your business can generate revenue and scale over time by taking inspiration from SaaS companies with demonstrated success.

2) Build your pitch deck

When you’re seeking pre-seed funding, it’s important to have a strong pitch deck. This will help investors see your vision and understand the potential of your business.

Your pitch deck should be well-organized and easy to follow. It should also be filled with engaging visuals that help to explain your business. Make sure to focus on the key points of your business, such as your value proposition, target market, and business model.

As a rule of thumb, your pitch deck should have 10-12 slides that each focus on one key point. If you’re struggling to put one together, try using a template!

3) Pitch your idea

Here are some great tips for nailing your pre-seed funding pitch:

- Keep it simple. We cannot stress this enough. Your job is to make a complicated process (i.e., building a business) look easy. This isn’t the time to show off your brilliance; it’s the time to get someone to invest in your ability to execute a great idea.

- Engage with questions. When pitching to investors, it’s important to engage with their questions. This shows that you’re confident in your product and that you’re willing to listen to feedback.

- Be realistic. Investors need to know that you (and your business) are grounded in reality. To that end, it’s important that you back up your claims with evidence.

- Let your passion shine through. If you want investors to get excited about your ideas, it’s important that you’re excited about them yourself.

4) Make use of rejections

Pre-seed funding is essential for many SaaS founders. But it’s also a risky proposition from an investor’s perspective. It’s unrealistic to think that every meeting you go into will net you the pre-seed funding you need.

However, don’t get discouraged! Not only is every rejection a learning experience, but you can often strategically utilize them to expand your network. Of course, this starts with being cordial and thanking the investor for their time. After that, you can ask if they know anyone within their network that may be interested in your business model.

You can even take this a step further and, prior to any propositions, delve into the investor’s connections on LinkedIn. Find another investor within their network that piques your interest. If the original investor rejects you, you can say something along the lines of:

“Hey, I noticed you’re connected to *Name of person*. Do you think we would make a good fit? If so, I’d really appreciate it if you could introduce us.”

Get the funding you need with Founderpath

Pre-seed funding is an essential step in the journey from idea to sustainable business. Without it, many founders struggle to validate their product or service—and their chances of ever raising significant outside capital diminish significantly.

At Founderpath, we’re here to help founders secure the funds they need to grow, scale, and improve their products. We offer upfront capital based on monthly recurring revenue (MRR), so you can get the funding you need without giving up equity or taking on debt.We also provide flexible, long-term repayment terms—so you can focus on growing your business! Click here to learn more about our funding options!