Getting SaaS funding is a nerve-wracking process for any SaaS founder. According to a recent report by the Silicon Valley Bank, $90 billion has been invested in SaaS startups in 2021 in the US alone. This is almost three times higher than in 2020 when the total investment was around $35 billion.

If you’re a SaaS professional or early-stage founder, running a SaaS company can be difficult without securing any capital. Almost all SaaS businesses need investments for sales and marketing, research and development (R&D), and other operations.

Founderpath helps bootstrapped SaaS founders secure capital from verified sources. You can turn your monthly subscriptions into upfront cash, with 12+ months to pay back without any late fee or penalty.

Securing funds without a plan may not give you desired results. So let’s learn all the essentials about SaaS funding and how Founderpath can provide you with ease.

What is SaaS Funding?

Specifically catering to software-as-a-service businesses, SaaS funding comes in many different forms. It considers the unique position that SaaS businesses have, including:

- Its online business model. Most SaaS businesses have a subscription- or credit-based business model that can help encourage customer loyalty.

- Its global reach. Most SaaS businesses have an online, global reach, compared to other businesses that may be more locally-restricted.

- Fixed costs. Aside from server-related costs, a technical founder can in theory launch and scale a SaaS platform by themselves, leading to costs that don’t necessarily increase as they get more customers.

- Scalability. Due to the global reach the internet provides and the different factors mentioned above, SaaS businesses can be potentially scaled at a global scale. For instance VEED, a video editing platform, bootstrapped their business to $7 million in annual recurring revenue through search engine optimization (SEO).

Today, many tools like Stripe and Profitwell allow SaaS businesses to reliably measure their revenue growth. SaaS funding options like Founderpath can integrate with these tools to audit a SaaS businesses’s revenue over time and provide non-dilutive funding.

5 Types of SaaS Funding

The types and terms of funding are continuously evolving and diversifying, providing more options to SaaS companies around the world.

Here are 5 types of SaaS funding you may need to grow and expand your business:

- Bootstrapping

Bootstrapping refers to establishing a startup with no external funding. Bootstrapping has its pros and cons. While it allows founders to maintain sole company ownership, it can sometimes limit growth and expansion. The market opportunities don’t wait long, so SaaS founders need huge amounts of capital to make the most out of them.

While bootstrapping is hard, it’s a more viable option than founders realize.Twitter has a lively community of bootstrappers that publicly share their monthly recurring revenue. For example, Sukh Sidhu is a bootstrapper that purchased Stridist, a CRM app for fitness and nutrition professionals, on MicroAcquire and grew the platform to almost $33,0000 in monthly recurring revenue (MRR)

That said, keeping external investors out can also impact the quality of your work. Many investors have significant experience in building SaaS startups. They can help you find the right product, create an efficient prototype, and make better marketing investments.

- Revenue-Based Funding

Revenue-based funding retains a founder’s control and ownership over the company and its operations. It provides minimally-dilutive growth capital, which is ideal for SaaS companies.

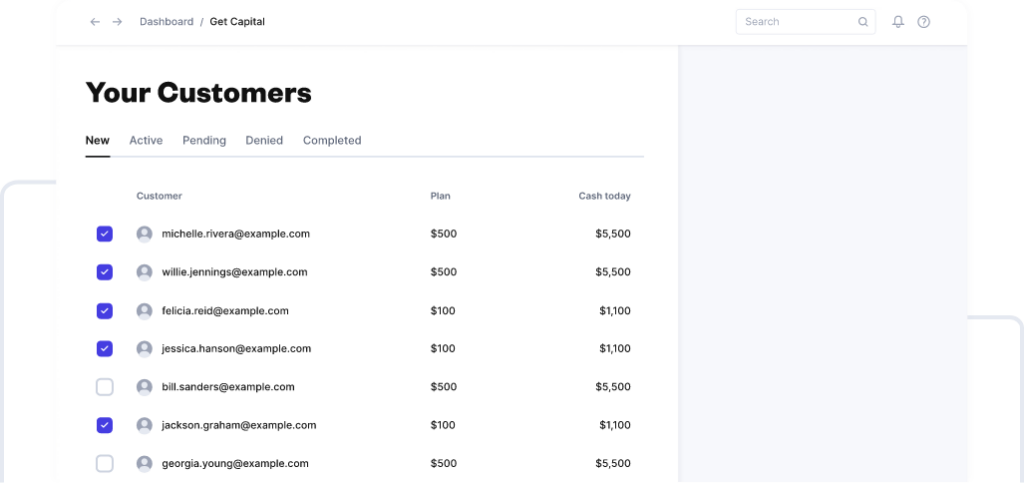

This type of SaaS funding provides flexible monthly payments. A type of revenue-based financing, Founderpath helps bootstrapped SaaS founders get capital investment, transforming their monthly subscriptions into upfront cash. To get your capital, all you need to do is to connect Founderpath to Stripe or a verified platform where you store customer and revenue information.

- Equity Financing

With equity financing, investors or venture capitalists (VC firms) become the partners of SaaS founders. Besides providing capital to the founders, investors also gain access to the SaaS startup’s critical company-building skills to help it grow.

Equity investors don’t accept SaaS founders to give an immediate ROI because the investment is long-term. This type of SaaS funding comes with less risk and is helpful in multiple business stages.

However, raising capital through equity financing is quite expensive and time-consuming. You will have to give up a considerable profit and more than half of your business ownership to the VC firms. This could result in an eventual loss of control of the founder over their startup’s direction.

The fund life is anywhere between 7 to 10 years. The investors expect you to provide returns and fulfill your KPIs within this period.

- Angel Investors

Angel investors are independent or informal investors who provide capital to a SaaS business in return for ownership equity or convertible debt. Unlike other funding types, these investors must have at least $1 million net worth or $200,000 annual income for the previous two years.

Angel investors usually support startups at the early stages with their personal money. For many SaaS startups, these investors are the primary source of financing with fewer risks and conditions.

One of the top angel investors is Paul Buchheit, creator of Gmail, who invested in over 200 companies, including Dropbox, Airbnb, and Reddit, with his own money. Jeff Bezos is another most active angel investor, having invested in Uber, Business Insider, Airbnb, and more.

- Venture Debt

This is a funding alternative for businesses with insufficient assets or cash flow required for typical debt financing. Venture debt only applies to SaaS companies with the potential to rapidly scal.

This debt typically turns into a non-convertible loan that founders need to pay back in monthly payments throughout the entire loan life. This is usually around 2 to 3 years.

Many banks and venture debt funds offer venture debt to SaaS professionals and early-stage founders. It leads to lower equity dilution than standard equity financing. Additionally, founders have more control over their SaaS business without giving up equity or board representation.

The lenders often include warrants that give them the right to buy equity in your business anytime. So if things don’t go well, they’d exit with a part of your equity.

A SaaS company needs steady funding to make its payments. If you don’t fulfill specific clauses of your loan document, it may result in the conversion of debt at very low valuations and further dilution.

5 SaaS Funding Stages

SaaS funding stages have different grades depending on the size of the company. For instance, pre-seed (the first stage) is meant for startups, while Series C (the final stage) is for large companies.

Most SaaS companies opt for venture capitalists and angel investors’ funding. So let’s focus on them as we discuss the five stages of startup funding:

- Pre-Seed

Pre-seed funding is the earliest stage of SaaS funding, coming from friends, family, founders, accelerators, dedicated pre-seed funds, and angel investors. This funding round helps get your business operations off the ground if your startup’s monthly revenue is below $25,000.

It is a small investment that assists a SaaS company in reaching an initial target, such as developing a prototype or marketing. It’s essential to have a solid founding team and compelling product to convince accelerators or angel investors to contribute to your pre-seed round.

For example, Clutch, a platform connecting content creators to companies, announced a successful pre-seed round of $1.2 million with the help of Precursor Ventures on August 4, 2022.

- Seed

Seed funding is another investment round in the initial stages of your SaaS startup, coming from friends, family, personal savings, crowdfunding, seed funds, and angel investors. SaaS companies with monthly revenue of under $150,000 can benefit from a seed round of over $500,000.

It is the first big investment a SaaS startup receives. It aims to fund product iteration and development goals and expand the founding team. For example, Stackwell announced a successful seed round of $3.5 million with the help of investors Michael Gordon, Jeremy Sclar, and The Kraft Group on August 3, 2022.

- Series A

Series A funding becomes essential when scaling your SaaS company to various business channels and customer segments. The investment amount in Series A funding differs in size but stays around $10 million. However, the amount can rise above this mark.

To compel potential SaaS investors, your company must establish KPIs, such as the number of subscribers onboard or MRR targets, to establish its growth path. Series A funding aims to improve current business processes related to these KPIs and prepare your startup for further growth.

An example is Invisible Universe, which raised $12 million in its Series A funding round with the help of Alexis Ohanian and Katelin Holloway’s Seven Seven Six on August 11, 2022.

- Series B

This investment typically comes from venture capital firms or SaaS Series ventures, as long as your SaaS company’s strong and compelling monetization strategy.

This additional capital will help reach demanding market expectations and new segments. So potential investors usually have high expectations from the performance of your business metrics and future success.

- Series C

Finally, Series C funding is an indication that you’ve made it. The typical Series C funding round is above $50 million, usually from banks, hedge funds, or venture capital firms.

This funding round helps you launch your business into new markets or facilitate other businesses’ acquisitions. For example, Xendit raised $150 million in their Series C funding, making their business worth $1 billion. A $300 million Series D funding followed this success, with the help of Coatue and Insight Partners.

Next Step: Finance Your Startup With Founderpath

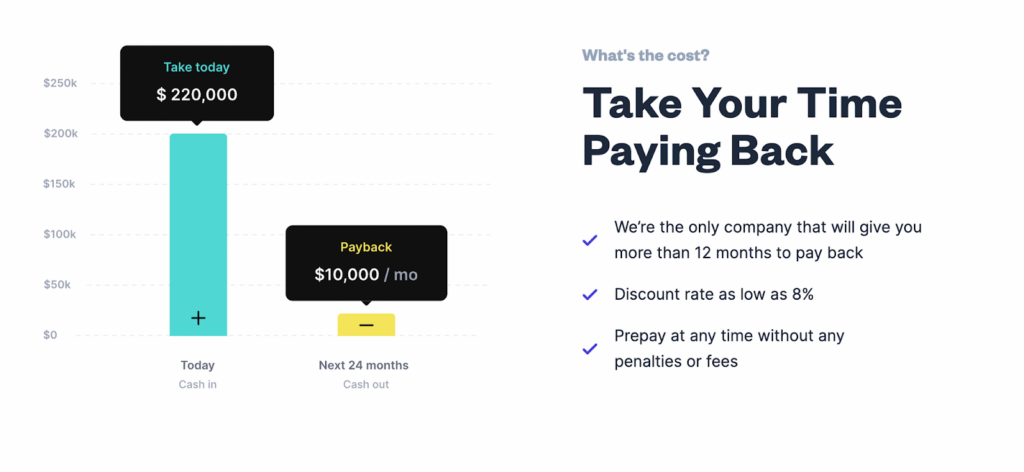

Almost all funding methods require you to give up some ownership, but that’s not the case with Founderpath. We allow you to gather capital without giving up equity and pay it back in more than 12 months.

As a bootstrapped SaaS founder, you can quickly turn your monthly subscriptions into upfront cash. Not only that, but you will also get free reporting and automated customer acquisition costs (CAC).

Want to hear something even more exciting? Founderpath also allows you to track your valuation based on what your fellow SaaS founders sold for (or raised at) in the past 6 months. Sounds interesting? Get a free trial to help kick off your SaaS business operations.