Securing early-stage financing can be the difference between your startup getting off the ground or remaining nothing more than an idea scribbled on a piece of paper. However, getting early-stage funding is often one of the most daunting challenges a startup founder will face in the company’s infancy.

At Founderpath, we help early-stage SaaS founders get funding and understand startup financing. Whether you are validating a business idea and want to know what growing it will entail or you are ready to start pitching—we will tell you everything you need to know about early-stage financing and how to secure it for your startup.

Types of Equity Funding

There are three primary types of equity funding for startup companies: seed financing, growth-stage financing and late-stage financing. Seed financing is the earliest stage of investment, typically provided by angel investors, friends, or family. Pre-seed money is typically used to cover expenses related to business development, such as market research or MVP development.

The seed round is the first formal round of funding, in which VCs or angel investors invest in exchange for equity in the company. As the name may suggest, growth-stage financing is used to fund growth and expansion, such as hiring new employees or opening new offices. Late-stage funding usually helps a company scale up its operations, acquire new companies, develop new products, or prepare for an IPO.

Early Stage or Seed Financing

Early-stage financing (also called seed financing) refers to the earliest forms of startup financing available, typically obtained from angel investors, venture capitalists, or self-funded by the founders. Seed financing includes two types of early-stage funding: seed and pre-seed.

Pre-Seed Financing or Bootstrapping

The pre-seed or bootstrapping stage is when a company is still in its infancy, or the business is often just an idea. This is when the founder(s) are looking for money to get the company off the ground. The most common way to finance a pre-seed stage company is through personal savings, credit cards, or friends & family. However, a few other options are available, such as pre-seed grants or pre-seed accelerators.

Seed Financing

A seed round is typically the first formal investment round in a startup. The funds raised in a seed round can be used to finance the business’s early-stage operations and help it reach the next stage of development. In this stage, the startup raises money from professional investors such as venture capitalists or angel investors.

The average amount raised in a seed round is $4 million. This capital can come in the form of equity investments, debt, or convertible notes (a bond that converts to equity at the business’ first priced round) and it’s usually provided in exchange for partial ownership in the company receiving the capital.

When to Seek Early-Stage Funding

Determining whether or not to seek funding for your startup ultimately boils down to what you are trying to accomplish and how much money you need to do so. Generally speaking, the less established your business is, the more difficult it will be to get investors.

If you are a first-time founder and haven’t thoroughly vetted your idea or gotten a product-market fit, we recommend starting here and handling this aspect before trying to bring in third-party investors. Without a proven concept or an excellent track record of launching successful startups, you will be hard-pressed to find a VC or angel willing to give you their money.

It is a good idea to start with the lowest-fidelity MVP (minimally viable product) and collect data. The goal of the MVP is to validate that there is a need for your product, that people are willing to pay for it and that you have found the right market for it.

In some instances—for example, in biotech and certain SaaS businesses, you may need substantial capital to vet your idea. However, in most instances, you can start with something incredibly cheap if not free. For example, start by creating a landing page or PowerPoint that explains the concept and then start showing it to your target customers and collecting their feedback.

Once you have data that can convince an investor that your product solves a problem, you can start working on your pitch.

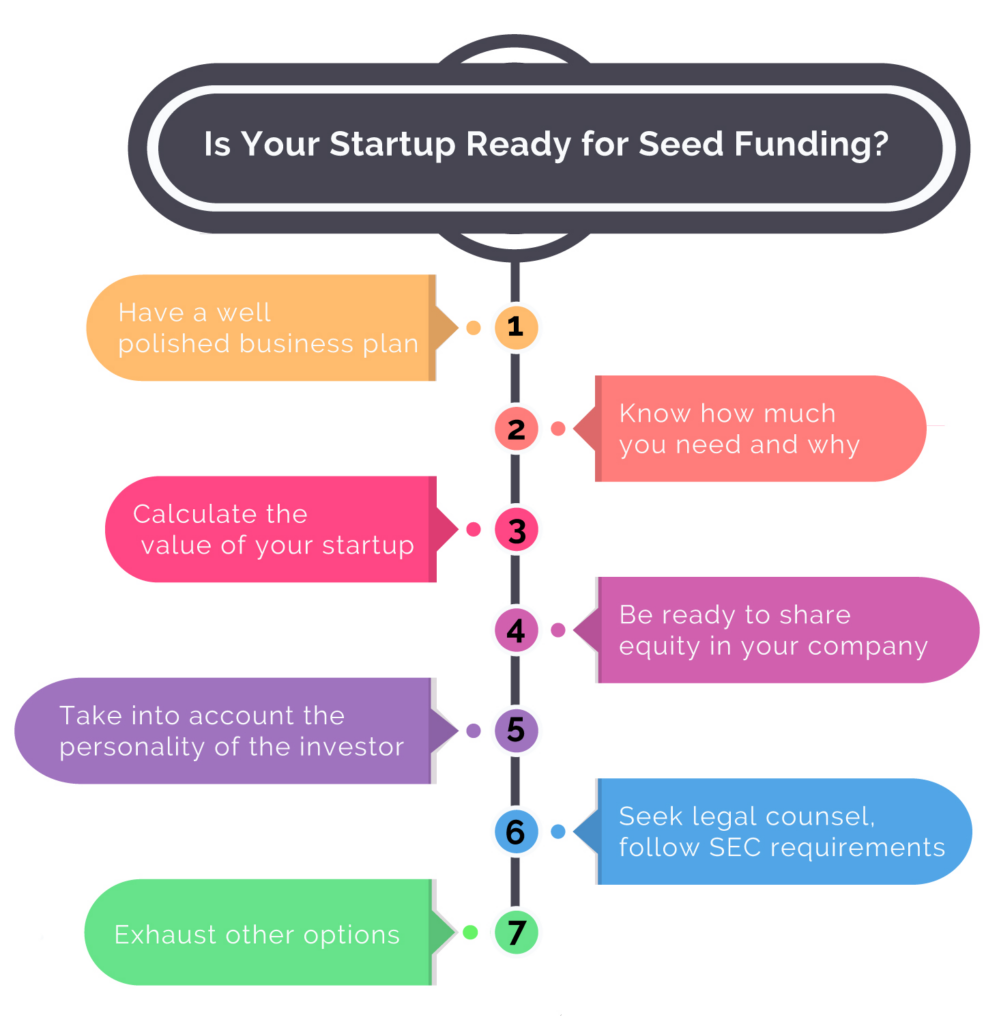

Source: Thinkloutions

Raising a Seed Round

At this point, hopefully, you have been able to use your own founder capital to validate your business idea. But inevitably, to grow and scale your startup, you likely will need external financing. The regularity of SaaS customer subscriptions allows Founderpath to offer your SaaS company up front finance based on the value of future payments, but there are many alternatives for funding.

Below, we will highlight the different options you have for funding when you are in the seed stage.

Friends and Family

Friends and family are the first option for seed (or pre-seed) financing. Unlike professional investors, your parents, siblings and close friends will likely be willing to invest in you before you have even validated your idea with an MVP. And unlike external investors, your grandmother will probably not try to replace you, push for a sale, or force you to step down as the company grows. So while these things make friends and family a desirable place for startup financing, using the people closest to you to fund your venture presents its own set of challenges.

Especially in the pre-seed round, where you are not certain that your business will succeed, there is a likelihood that your business will fail and you will lose the money that your friends and family invested. For obvious reasons, this can strain these relationships and cause you to lose friends and put your loved ones in challenging financial situations.

For this reason, if you choose to approach friends and family for investments, you should make it very clear to them that they could lose every penny of their investment. Although you may be confident that your business will work, you should not try to convince them that it will succeed but rather that you will do everything you can to make it succeed but that it may fail.

Finally, another downside of friend and family investments is that unlike VCs or experienced angels, your brother or uncle probably will not add the same non-monetary value that a third-party investor does. As you get into the later stages of financing, potential investors will not be thrilled to learn that your mechanic brother owns a third of your business.

Angel Investors

An angel investor is a high-net-worth individual who provides pre-seed, seed, or early-stage financing for a startup. Angel investors typically invest their own money and are not beholden to outside firms or organizations. As such, they can take more risks than VCs by investing in unproven startups with great potential. However, angel investors are looking for the same thing from startups as VCs: high returns on investment with lower risk and higher rewards.

Angel investors are generally a bit easier to work with than VCs. There is less paperwork involved and faster payment times than you have with investment firms. Like VCs, angels can provide industry expertise and growth council and connect the founder with potential talent, partners and other investors. However, their ability to do so varies between individual investors, so it’s essential that you also interview the investor to make sure they will be able to provide the guidance you need.

Keep in mind that because angel investors do not have external organizations funding them, the amount you can raise from an angel is substantially less than VC funding—but often, with early-stage financing, it’s enough.

Venture Capitalists

As you probably know, a venture capitalist (VC) is an investor who provides capital to companies in exchange for an equity stake. VCs typically invest in companies at different stages, from pre-seed money to later-stage rounds. The amount of money you can expect to raise from VCs depends on your business’s stage.

Venture capitalists can provide much more than monetary value. They can connect you with the right people, advise you on how to grow and set the stage for future funding. As with any investor, there are good VCs, bad VCs and the right ones for your business. So as with any strategic partner, you must ensure that the firm you choose to work with has a strong track record and understands your industry.

As with any investor relationship, there are downsides to working with VCs. The biggest one is a formal reporting structure and they will often insist on being a part of your board of directors. This comes with many implications, such as VCs being able to dictate your pay, or, more concerningly, replace you if they deem you unfit. However, while it comes with its costs, VCs can still substantially impact your ability to scale your business.

Accelerator Programs

Another popular option for early-stage financing is an accelerator or incubator program like Y Combinator. These programs provide you with an initial investment to help get your company off the ground. Additionally, they offer mentorship, resources and connections that can be invaluable for a young company.

While they are competitive, accelerator programs don’t have the same stipulations as VC investments but can still connect you with reputable venture capitalists for future rounds.

Founderpath

Founderpath is another excellent option for short-term financing if you are a SaaS organization. Turn your monthly subscribers into upfront cash without interest,debt or having to hand over equity. Then, get over 12 months to pay back the cash advance and start scaling your business today.