According to Startup Genome, 90% of startups fail. If you want to become part of the successful 10%, you have a lot of ground to cover, and that begins with pre-revenue startup funding.

Don’t worry though, this is sure to be one of the most exciting times for you in your journey as an entrepreneur, so it’ll be worth the challenge. Bootstrappers worldwide are taking advantage of revenue-based resources for quick capital to grow their business!

If you’re uncertain of what your business needs, you have a wide array of funding options to choose from, so you can rest assured that you’ll find something to be a good fit. In addition to that, you’re always free to use your own mix of small business funding options to suit your financial needs and goals.

What matters most is that you focus on whatever source matches up with the structure and purpose of your business.

Startup funding options for founders

Revenue-based funding

Great for: Startups with a predictable recurring (subscription-based, preferably) revenue stream.

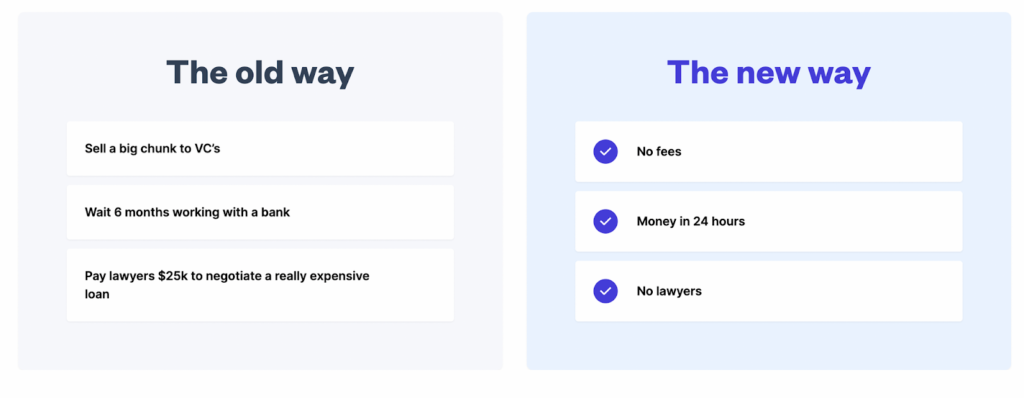

When you’re just starting out on your entrepreneurial journey, it can be overwhelming to think about where you’re going to get funding. Even if you have a customer base, you need capital to scale growth. That’s where Founderpath comes in. This platform is a type of revenue-based funding and gives SaaS and other founders early access to funds from their customer subscriptions.

One of the biggest reasons SaaS founders go to Founderpath for their startup funding is retaining equity. When you use a revenue-based loan model, you don’t need to give up any ownership, which can be generally important to a budding entrepreneur.

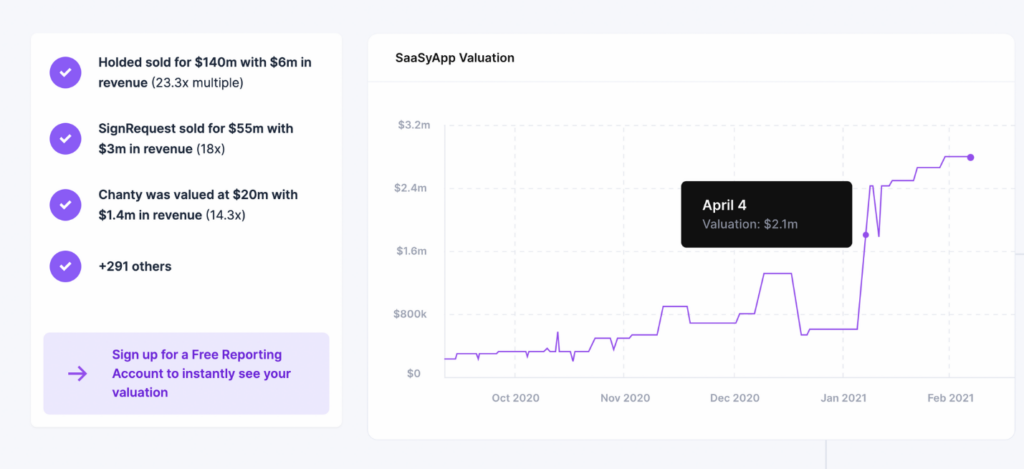

If you like real-time data and valuable business insights, check out Founderpath’s valuation tool to get a better sense of what your goals should be. There’s no such thing as too much information as you navigate the world of being a founder.

All you need is to link your revenue reporting tools to our platform, and we’ll assess whether you’re fit for a loan or not. Once accepted, you get the funds in less than 24 hours, no questions asked.

Personal investment options

If you don’t want to rely on any type of outside investment, welcome to the bootstrapper’s club! Many founders pride themselves on the notion that they built their business without a dime from anyone else. While this isn’t for the faint of heart, it’s certainly possible. There are a couple of ways you can do this:

Personal loans for business

Great for: Founders with a great credit score.

You might want to consider a personal loan for your business if you have exceptional credit and confidence in your business venture. Personal loans for your business are just as straightforward as they are for you as an individual. You’ll avoid confusing formulas and fees, however, you will assume the liability for the loan, should the business fail.

Personal savings

Great for: Founders with enough capital to spend

If you’re truly confident in your business idea, then you might consider using a portion of your personal savings to offset startup costs. This is a safer route for those who are anticipating an SBA loan soon since you know you’ll be able to replace the expense.

Cons of personal financing:

- Higher interest rates

- You put your personal credit at risk

- Loan amounts are generally lower

Friends and family

Great for: Founders with a personal network ready to invest for their success

Some people don’t love the idea of going to family and friends for startup money, but if you don’t qualify for a loan, or just want to diversify your funding, you might have to. Make sure you propose your idea with the same professional demeanor you would any other investor. They need to understand what’s in it for them and why they can trust you to deliver on your word.

If you decide to take the love money route, great! You’re lucky to have that support as you continue your business ventures. However, because this might feel more casual than walking into a bank or sitting down with a panel of investors, make sure you come up with a system. You’ll want to keep track of all the funds you receive, where they are allocated, and any other relevant information deemed appropriate by professional counsel.

Crowdfunding

Great for: Companies with an established audience that want to see the business launch products and succeed.

Crowdfunding involves seeking out many individuals to donate to a common purpose. Many startup founders get their ventures started with crowdfunding techniques, so it’s worth considering.

If you’re interested in getting a lot of people excited for the launch of your product, but you still need more money to get it finished, crowdfunding is the perfect way to have users invest directly into your product. You can offer different things in return for the funds you receive, depending on what incentives suit your company best.

Some founders even consider equity crowdfunding, which awards people with company equity in exchange for their startup funds.

Small business bank loans

Great for: Startups with decent revenue, a strong business plan, and a promising valuation.

Banks offer working capital loans and funding as the two main options for business loans. Working capital loans are determined by estimating one year of revenue-generating operations. Funding refers to your typical process of presenting your business plan and valuation. Generally, you must provide some form of collateral, but there are collateral-free options in certain countries.

Small business lines of credit

Great for: Startups that need a short-term cash injection to finance a part of their business.

Like a hybrid model of a business credit card and a bank loan, a line of credit is a more flexible option for funding. You can access these funds at any time, with a cap on the total amount granted.

These are useful for unexpected startup expenses and maintaining solid cash flow.

Government grants and subsidies

Great for: Founders in certain industries

The government creates different grants and programs to ensure that certain groups and populations have access to business resources. Most of the time you’ll have to apply for a grant that applies specifically to your industry or personal demographic to get approved.

Business incubators

Great for: Founders that want to gain access to a network of fellow founders, businesses and investors.

Startup incubators are a great solution for entrepreneurs who want support during the early stages of their startup and business resources in a collaborative environment. These organizations exist in most cities When you join a business incubator, you can expect:

- Access to experts

- Mentorship

- Legal counsel

- Accounting assistance

- Utilities, equipment, and use of facilities

One of the most efficient ways to find a business incubator that suits your needs is through a referral. To do this, try to seek out a founder in your industry with goals that resonate with your own. If you need access to a community of thousands of founders like yourself, consider getting started with Founderpath.

SBA Microloans

Great for: Founders typically underserved by traditional banks, including minorities and from low-income backgrounds.

SBA microloans started out as a means to allocate more funding to women, minorities, and veterans. The U.S. Small Business Administration’s SBA microloan program allocates these funds with the help of nonprofit, community-based, intermediary lenders. You can expect interest rates in the range of 8-13%, with a maximum term of six years, and an allotment of anything from $500 to $50,000 depending on the details of your business and your needs.

Invoice financing

Great for: Startups with a good client base that needs cash to speed up growth

Borrowing money based on unpaid invoices, this financing is an attractive option because of the short time it takes to get it. This type of funding doesn’t require any specific amount of time in business or a large customer base. The only proof you need to present is one invoiced customer. Once you submit your customer invoice, you’ll be able to acquire an advance for part of the invoice amount.

Choosing the right funding option

There are a few different conditions you’ll want to consider when you compare your options for startup funding. Take these into consideration when weighing your options:

- Startup industry

- Business plan

- Age of the business

- Annual revenue (if any)

- Credit score

While your dad might not hold your credit score against you, he’s still going to want to see a solid business plan and have faith in your chosen industry. Revenue- and invoice-based financing are great for startups that are earning revenue in some form, but aren’t for those in the pre-revenue stage.

If you aren’t sure where to begin, start with conferences that focus on your industry. You can request to attend Founderconf 2023 next year if you’re interested in meeting top SaaS founders with over $5 million.

Need financing?

Whether you’re working on a business plan for a new business or have already been in business for over a year, understanding your funding options is imperative to your success. The more educated you are, the more of an informed decision you stand to make. With all of this in mind, you’re already on track to getting the funding you need and securing the future you desire. If you haven’t already you should start with a valuation of your business before you begin to evaluate what type of funding you’re going to need.