You don’t want to be one of those founders who loses it all. You aren’t on this journey to experience unimaginable success, only to have it all taken away because you weren’t prepared enough to keep up with the demands of expansion, right?

Well, CB Insights reports that nearly a third of all startups fail because they run out of funding or personal money. If you want to avoid this kind of setback, consider using a revenue-based loan to prepare your business for growing demands and expansion.

If you’re still in the beginning stages of your startup, revenue-based financing can be useful if you have a scalable online business (e.g., SaaS, eCommerce, selling digital products, etc.). You can begin your startup business funding with helpful resources like Founderpath, a network for tech founders who need quick access to startup funds.

What is revenue-based financing?

Also referred to as revenue-based investing or revenue-share financing, this form of royalty-based funding allows you to pay back financing with a fixed percentage of your future revenue on a weekly or monthly basis until your loan is paid.

Here’s an example:

- Sassy, a SaaS analytics platform, borrows $100,000, with a repayment capped at 1.2x ($120,000).

- Say Sassy has a revenue share of 3%.

- Sassy would therefore have to pay 3% of its gross revenue each month, until $120,000 has been paid.

- So if it earns, $1,000,000 in monthly revenue it’ll have to pay: 1M*0.03 = $30,000.

- In periods of downturn where their monthly revenue is lower, Sassy will pay a lower amount. The opposite is true for periods in which Sassy earns more than expected.

The main benefit here is that Sassy pays the lender based on its monthly growth performance until the whole amount has been paid, allowing Sassy to more effectively weather downturns by having an extended cash runway.

Who should consider revenue-based financing?

This type of funding is generally best for companies with subscription-based models or high gross margins. The funding is a way to scale your business to move to the next level of business operations.

You might want to consider a revenue-based loan if you fall into any of the following categories:

Your company is too small for a venture capital firm

It’s entirely possible you have consistent revenue streams and lack the actual numbers of personnel that typically attract large VC firms. Your company might be small, but your impact will be better noticed with something like a revenue-based loan.

You want to retain control over your operations

Most people don’t come up with a business idea only to think about giving it away. Of course, with some deals being impossible to turn down, it’s normal for some to give in. However, you likely want to hold onto your company if it’s doing well.

With a revenue-based loan, you’re receiving an amount of money to pay back at a later time. There is not an exchange of equity with this type of funding, so you can rest assured that you’ll retain ownership as you make flexible payments!

You haven’t had any luck with other financing options

When it comes to business funding, there are all kinds of criteria you need to meet for different types of financing options. Some of these options require you to be in business for a certain number of years or have a certain credit score.

If you want more insights into your company data, Founderpath provides a thorough valuation based on real-time data to make sure you’re getting everything you deserve. You can also explore other useful customer and business metrics that will help you decide on what type of financing is right for you.

What are the advantages of revenue-based business loans?

Some of the benefits you can expect from a revenue-based business loan are:

Flexible repayment

Many founders enjoy revenue-based loans for the repayment structure. If you run a company that experiences ebbs and flows with the seasons or for any other reason, this type of repayment plan is perfect. You won’t have to worry about a fixed payment, knowing whatever you need to pay will be directly proportional to your business performance.

Easier to get approved

Unlike other sources of funding, revenue-based business loans don’t require you to be in business for any specific time or have a credit score. You also won’t need to put up any collateral to get approved. You just need to prove your company’s ability to generate revenue.

If you find it difficult to get a traditional loan but have a strong bottom-line, a revenue-based loan might be a better option.

Faster funding

Sometimes you might deal with delayed payments because of how your customers pay. With a revenue-based loan, you won’t have to worry about that again. The only thing you need to do is report monthly revenue.

Maintain your ownership equity

Of course, retaining ownership is key for any business founder. After all the hard work you put in to get the funding together and get it off the ground, you deserve to hold onto it. These loans only require repayments, not any transfer of equity.

What are the disadvantages of revenue-based business loans?

If you’re considering a revenue-based loan, it’s important to understand any shortcomings of this method. Some of the disadvantages you might encounter include:

You need to have revenue

Most lenders assess you on your ability to generate revenue based on past performance. At Founderpath, we do this process automatically by connecting to your revenue reporting tools. In other words, this isn’t viable for very early-stage bootstrappers that have yet to secure a consistent monthly recurring revenue.

Costs more money

Since you’re able to qualify for a revenue-based loan with a low credit score, they can cost more over time. Your interest rates and fees will be higher than your typical bank loan. While not ideal, it’s necessary for loans that are at risk of not being paid back.

The repayment schedule isn’t certain

At first glance, the revenue-based payment play seems like a no-brainer. However, you need to think about how it’ll affect your ability to spend on other items when your revenue is extremely high. You might not have the same amount of money at your disposal as you would with a fixed payment.

Similarly, lower growth might mean a lower payment, but it means more interest over time if you’re not paying it off as quickly as you would a traditional loan.

Not open to all niches

As previously mentioned, this type of loan is really intended for subscription-based business models and high gross margin companies. So, it isn’t a one size fits all option.

How do I get a revenue-based business loan?

It’s more difficult to find lenders for this type of financing, so try to be patient as you navigate the process. The best way to begin is by making sure you have all the documentation and qualifications necessary to make your application stand out. Take the following steps when seeking out a revenue-based business loan:

Locate a lender

You might think about contacting a bank, but you won’t find revenue-based loans there. Instead, you need to seek out a firm that specializes in revenue-based financing.

Depending on where you’re based, this will require some research. If you’re just starting out, Founderpath is a great solution that saves you the time and effort of locating a lender and is available in most countries.

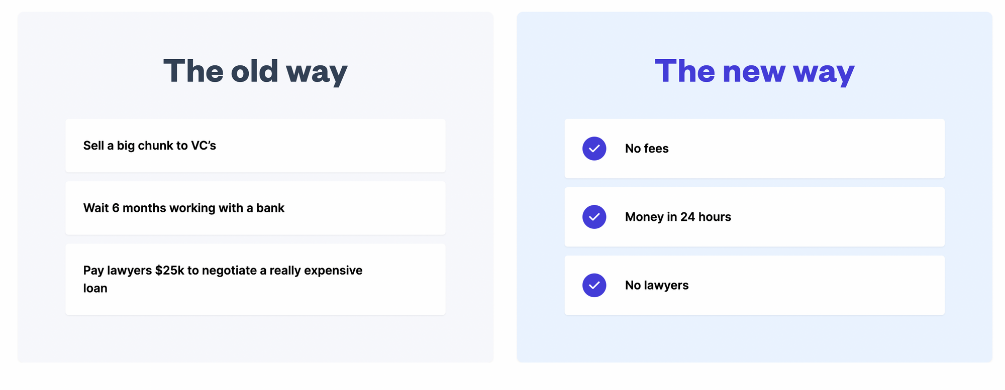

Once you connect your revenue reporting tools to FounderPath, we’ll analyze your revenue, and you’ll receive funding in under 24 hours once you get accepted:

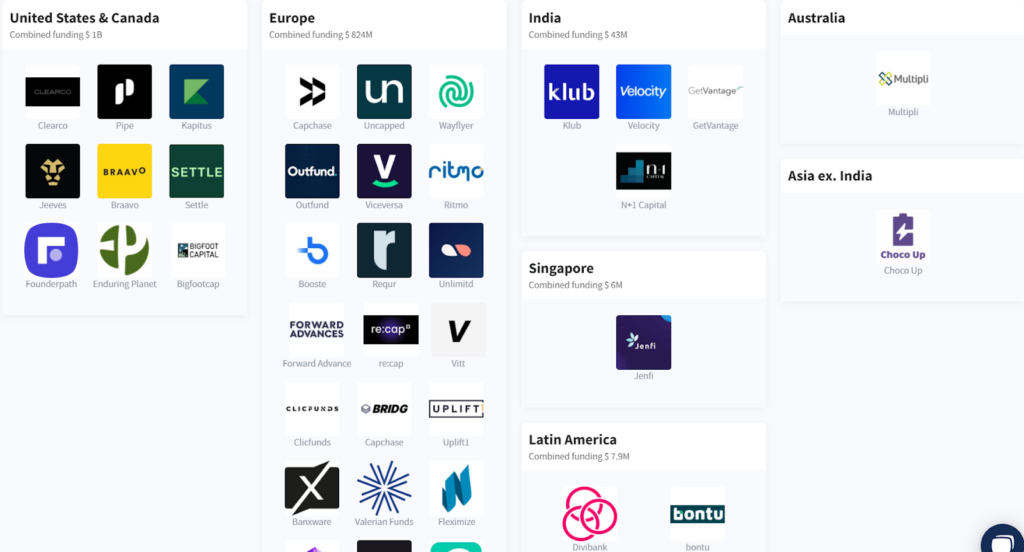

Want to find nice alternatives? Dealroom identified 30+ startups that offer revenue-based business loans all over the world.

Nail the application

Include all relevant personal and business information for the lender.

With many lenders, you’ll need to provide things like:

- Business balance sheet

- Profit-and-loss statement

- 3-12 months of business bank statements

- A business plan

Project potential growth

As previously mentioned, revenue-based loans are geared towards companies with high gross profit margins.

Most of the time, lenders want to see at least a 40% gross profit margin for any qualifying candidates. This will prove your potential, which you then want to back up with a business plan to prove how you’ve thought it all out. Remember, your ability to pay back the loan depends on your revenue stream, so be sensitive to that when interacting with your potential lender.

Allocate future funds

You might think this is common sense, but it’s an important part of preparation. Make sure you know exactly how you intend to spend the loan. The lender needs to understand your purpose and how the loan will contribute to the growth of your business and lead to higher revenues.

Consider your options

At the end of the day, you’ll benefit from doing some research, but there are plenty of digital platforms out there that can help you get started.

Founderpath is a great option for business owners with subscription-based models. You’ll have access to your funds almost instantly, letting you focus on your daily business operations and growth.

Are revenue-based loans better than venture capital or equity financing?

When comparing revenue-based loans to capital or equity financing, it really comes down to the characteristics of the company and the values of the founder.

With a VC or any other form of equity financing, you’re giving up ownership in the business. Revenue-based financing doesn’t require the founder to exchange any ownership, at any time. So, if you want to maintain ownership of your company, you’ll probably want to check out revenue-based lending first.

VCs also typically go for larger companies than revenue-based lenders. To put it simply, you won’t usually find the same candidates looking toward equity financing and revenue-based financing.

Alternatives

If you don’t think a revenue-based loan is right for you, that’s okay too! There are plenty of business funding options out there to match each founder’s needs.

Other business financing options include but are not limited to:

- Angel investors

- Venture capital

- Crowdfunding

- Peer-to-peer loans

- Microlending

- Business credit cards

The Bottom Line

With a revenue-based loan, you’re getting a sum in advance, to be paid back in proportion to how well your business is performing. You won’t need to worry about making a larger payment if your revenue is lower than expected. Remember, if you aren’t quite ready for this level of funding yet, you can still get started with the bootstrappers. Start a free account with Founderpath and start converting your subscriptions into real startup income almost instantly.